Content Library Items

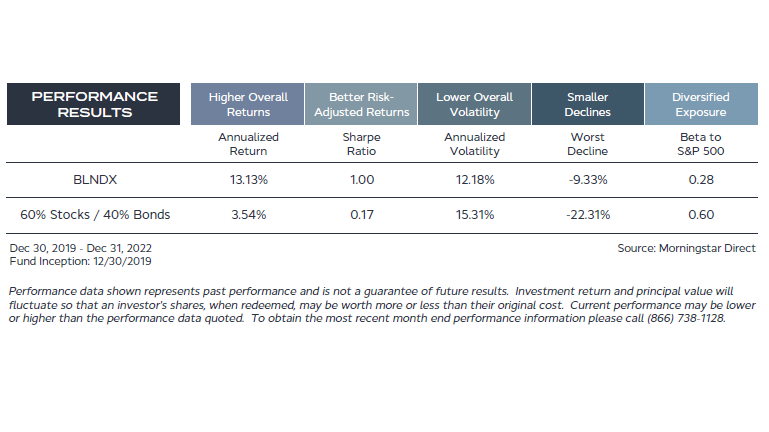

Standpoint vs. 60% Stocks/40% Bonds

Web Page

See how Standpoint stacks up against the traditional 60/40 stock/bond portfolio.

See more

See moreMonthly Returns

Web Page

Monthly returns for the Standpoint mutual fund since inception.

See more

See moreAsset Class Comparison

Web Page

Since the inception of the fund investors have experienced a broad range of market environments.

See more

See moreAnimal Spirits Podcast - July 2024

Podcast

Eric Crittenden joins Ben Carlson and Michael Batnick from Animal Spirits on an episode of Talk Your Book.

See more

See moreThe Weighing Machine Podcast - August 2024

Podcast

Eric Crittenden joins Rusty Vanneman on an episode of The Weighing Machine, a podcast from Orion Advisor Solutions.

See more

See moreTalkin' Shop: Benefits of a Systematic Approach

Video

Eric emphasizes the need for discipline when entering and exiting positions, rather than relying on news or predictions.

See more

See moreStandard Deviations Podcast – Nov 2023

Podcast

Eric Crittenden joins Daniel Crosby on an episode of Standard Deviations, a podcast with a focus on the behavioral aspects of investing.

See more

See moreExcess Returns Podcast - October 2023

Podcast

Eric Crittenden joins Jack Forehand and Justin Carbonneau on the Excess Returns Podcast in October 2023.

See more

See moreEric on Forward Guidance Podcast - June 2023

Podcast

Eric Crittenden joins Jack Farley on an episode of Forward Guidance.

See more

See moreStandpoint – A True All-Weather Approach

Article

Writer Tony Dong proposes Standpoint as an interesting alternative to the 60/40 portfolio moving forward.

See more

See moreMan Institute – Trend Following

Article

Trend following strategies perform as well as equities in the long term, yet get there with lower risk and smaller drawdowns.

See more

See moreA Vehicle For All Market Environments

Video

Standpoint’s multi-asset approach is the SUV of investments. It has the ability to perform reasonably well in most economic environments.

See more

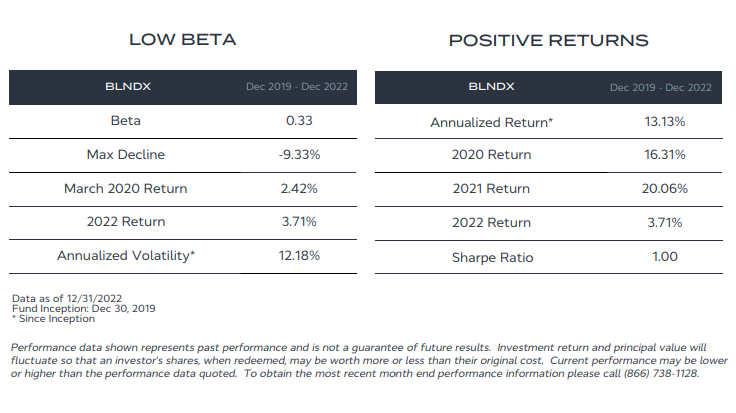

See moreLow Beta and Positive Returns

Web Page

See how Standpoint performs on these key metrics that investors evaluate: Beta and Returns.

See more

See moreCovel Podcast – March 2023

Video

A clip from Eric’s conversation with Michael Covel on his podcast Trend Following Radio.

See more

See moreReturn and Risk - Audio Clip

Video

You don't always end up seeing the risk that you take. When you do it's often too late to do anything about it.

See more

See moreDesigning The Strategy - Audio Clip

Video

Eric shares his experience researching and building investment strategies and some of the surprises he ran into along the way.

See more

See moreChief Investment Officer - Audio Clip

Video

Eric shares a little bit about his experience and why he loves the role he's in now.

See more

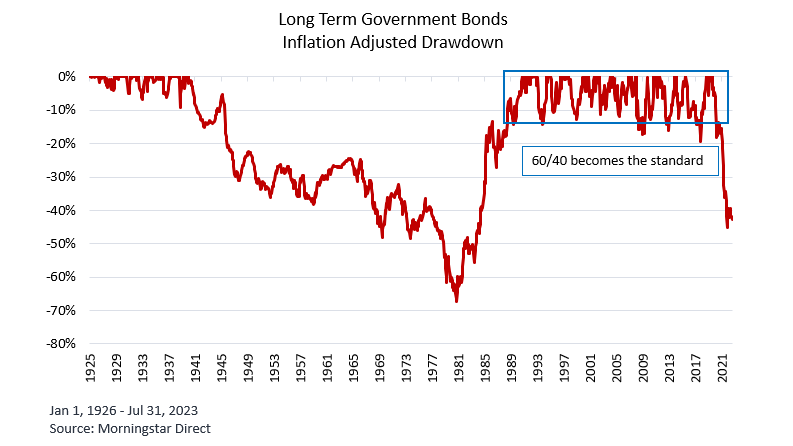

See moreGovernment Bond Drawdown - July 2023

Article

Long term government bonds are experiencing their first inflation adjusted drawdown greater than -20% since the 1980s.

See more

See moreThe Derivative Podcast - September 2022

Podcast

Trends, Inflation Protection, & Getting Investors to the Finish Line with Eric Crittenden of Standpoint.

See more

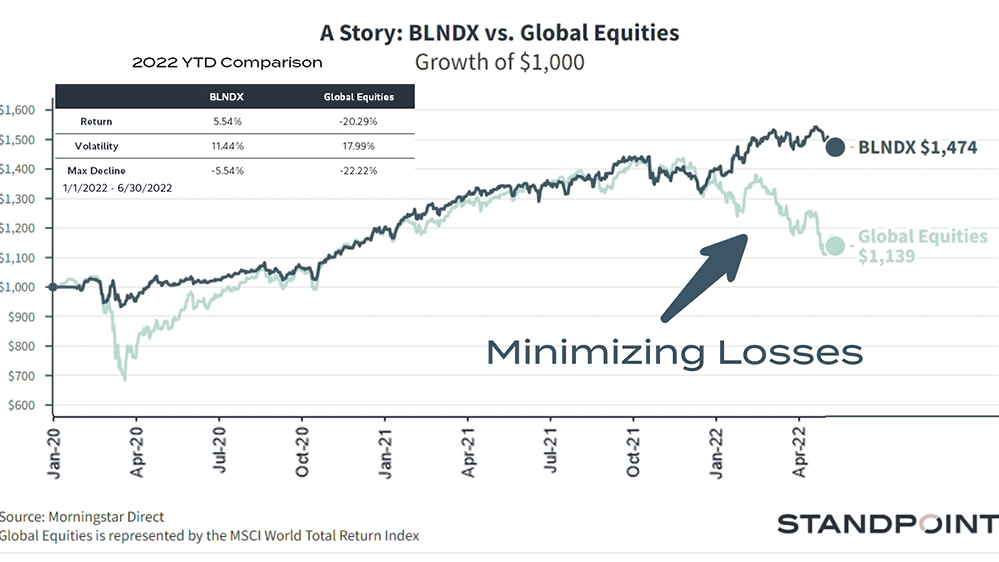

See moreA Story: Standpoint vs. Equities - June 2022

Video

A two-minute video with commentary on how an all-weather strategy can take advantage of market trends around the globe.

See more

See moreMutiny Funds Podcast - June 2022

Podcast

Eric Crittenden and Jason Buck discuss how to handle today's market environment.

See more

See moreReducing Inflation Will Come at a Great Cost: Stagflation

Article

Ray Dalio outlines the costs of central bank policies of the past, present, and future.

See more

See moreMarketwatch - March 2022

Article

This type of investment strategy can smooth out the stock market’s ride.

See more

See moreEric and Meb Faber - January 2022

Podcast

Eric joins Meb to discuss recent market volatility and possible risks and opportunities that lie ahead.

See more

See moreTalkin' Shop: Motivation to Change

Video

Diversification away from stocks and bonds is more important today.

See more

See moreWhy Most Alternatives are Ineffective

Video

Most alternatives are taking the same risks as the rest of the portfolio.

See more

See moreTalkin' Shop: The Pain of Diversification

Video

Why does diversification feel so painful?

See more

See moreReal Vision Masterclass - August 2021

Video

Eric Crittenden and Standpoint specialize in a systematic investment style that they like to call “macro trend investing” that they also combine with long equity beta.

See more

See moreExplaining All-Weather

Web Page

See quotes that are common ways advisors and investors describe all-weather investing.

See more

See moreAll-Weather Investing with Tom Basso and Eric Crittenden

Video

Standpoint's Eric Crittenden and Tom Basso have a casual conversation about investing and their experience as professional money managers.

See more

See moreSebastien Page - February 2022

Podcast

Sebastien Page joins Alan Dunne on Top Traders Unplugged.

See more

See moreOrigin Story: All-Weather

Video

A student project leads Eric to discover an all-weather approach to investing.

See more

See moreOrigin Story: Tom Basso and Standpoint

Video

On RCM's The Derivative podcast Tom Basso shares a story of the early days of Standpoint.

See more

See morePicture Perfect Portfolios Interview

Article

Samuel Jeffery of Picture Perfect Portfolios interviews Eric Crittenden about various topics related to successful all-weather investing.

See more

See moreOver-Reliance on "Education"

Video

"No amount of education is going to solve that particular problem."

See more

See moreTalkin' Shop: Sharpe Ratios

Video

Eric talks about realistic expectations around Sharpe ratios and his views on the best way to target a reasonable number.

See more

See moreTalkin' Shop: Real Estate and All-Weather Portfolios

Video

Eric discusses why he doesn’t include real estate in Standpoint’s all-weather strategy.

See more

See moreEric's Life Principles

Video

Realistic expectations, unintended consequences, Pareto principle.

See more

See moreBeing Prepared

Video

Severe or prolonged equity market declines. Inflation. Negative real returns from bonds. Are you prepared if any of these scenarios materialize?

See more

See moreThe Basics of All-Weather Investing

Video

What is all-weather investing? Is an all-weather portfolio too diversified? What do we think about stock and bond portfolios?

See more

See moreSystematic Trading & Trendfollowing

Video

A brief explanation of systematic trading and the trendfollowing investment style.

See more

See moreThe Right Lessons From History

Video

“Some people think that it’s science, some people think it’s art. I’m just telling you it’s crucially important.”

See more

See moreTalkin' Shop: Different Market Environments

Video

The four economic environments and how the investments that make up a portfolio will perform differently in each of the four ‘quadrants.’

See more

See moreTalkin' Shop: Using ETFs for Strategic Equity Exposure

Video

In an all-weather investment approach, strategic long equity exposure makes up an important portion of the portfolio.

See more

See moreBlackRock Makes the Case for 20% Alternatives

Article

Why the traditional stock and bond allocation will not only fall short on returns but actually increase risk.

See more

See moreResolve Riffs – April 2021

Podcast

Eric, CIO of Standpoint, joins Adam, Rodrigo, and Mike of Resolve Asset Management for a Friday happy hour conversation.

See more

See moreExcess Returns Podcast - April 2021

Podcast

Eric, CIO of Standpoint, joins Jack Forehand and Justin Carbonneau on an episode of their podcast, Excess Returns.

See more

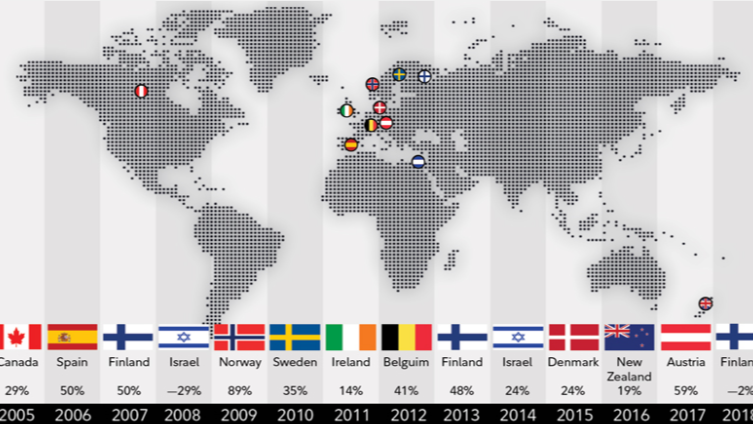

See moreU.S. vs. International Equities

Article

Blending U.S. and international equities has historically delivered returns equal to U.S. equities alone but with less volatility.

See more

See moreOrigin Story: Standpoint

Video

Why does the team at Standpoint believe advisors and investors want another investment product in an industry that already has over 8,000 mutual funds?

See more

See moreEric on Flirting with Models Podcast - July 2020

Podcast

Eric, CIO of Standpoint, joins Corey Hoffstein on a podcast episode of Flirting with Models.

See more

See moreRob Arnott on Excess Returns Podcast

Podcast

Research Affiliates’ and Standpoint’s philosophies around investing are different, but we share many of the same principles.

See more

See moreBridgewater - Is Stagflation Next?

Video

Policies used in 2008 were to stop-gap a lack of credit in the system, but in 2020 we are experiencing different underlying issues.

See more

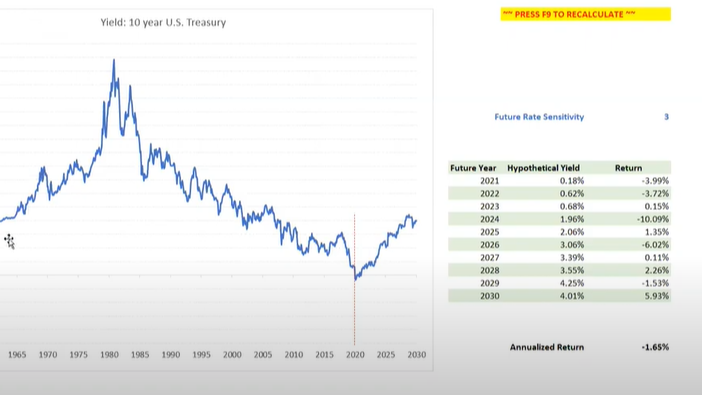

See moreBond Return Simulator

Tool

Walkthrough of how to use the bond return simulator created by Standpoint.

See more

See moreDimensional - What Happens to Stocks when Interest Rates Change

Video

There is no clear correlation between U.S. equity market returns and interest rates.

See more

See moreAccess to All-Weather

Video

Many portfolios are heavily focused on the stock market and long term bonds are a bad bet right now.

See more

See moreCommentary

Web Page

Monthly updates on portfolios positions and performance.

See more

See moreFact Sheet

Web Page

Quarterly Fact Sheet for the Standpoint Multi-Asset Fund.

See more

See moreFund Brochure

Web Page

An overview of the goal and components of the Standpoint Multi-Asset Fund.

See more

See more